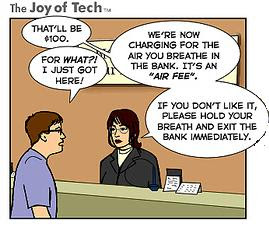

Although I survived the most recent round of layoffs, I'm not sure how much longer I'll be employed. In the event that I'm laid off, my automatic deposits will stop and my brick and mortar checking account will start charging me a fee.

Of course, I have the option of transferring some of my savings money to my non-interest bearing checking accounts so that I can meet the minimum balance at which the banks will waive the monthly fee. Screw that.

I currently have an automobile loan and a muy pequeno savings account with a local credit union. (The majority of my savings are with online banks like ING and DollarSavingsDirect.) I decided to open a checking account with my credit union since it offers free checking (minus cost of paper checks) with electronic statements. Sweet!

But in order to open an account, the credit union ran my credit report. Uhhhh... Not so good. I was recently so happy about increasing my FICO score to 712. Bummer. This'll take a hit.

With my new checking account number in hand, I tried to link it electronically to my ING savings account. Unfortunately, I was stumped by ING's security questions. I clearly got one or all of the questions wrong. For example, it gave me a list of phone numbers and asked me to choose the number I've had in the past. Are you serious? None of them looked familiar. Does anyone really remember the phone number they had during college?

[Sigh.] I'll now have to order paper checks and send a voided copy to ING to link my account. What a hassle!

While we're on the topic of ordering paper checks, in this age of online banking, I surprisingly have occasions where I still need to write paper checks (e.g., my rent, linking online banks). So I usually purchase my paper checks from Checks in the Mail. When ordering, I always check to see if anyone has posted any discount codes on the web. Sure enough, I found a couple: "couponcraze" (save $1 off check order) and "save20" (save 20% off check order). Cha-ching!

Once this is all complete, I'm also considering opening ING's Electric Orange checking account and making that my primary checking account since it offers an interest rate of 1.5% APY. ING is currently running a $50 bonus promotion right now to those who have an existing Orange Savings Account. (Reference code: EM227). The only problem with this offer is that you'll have to activate your Mastercard debit card and make 3 signature-based purchases within the first 45 days the account is open.

Maybe my goal next year should be simplifying my banking. This is getting out of control!

7 comments:

I want to switch to a credit union too, thanks for the info. Bank fees are the bane of my existence and at the credit union my coworkers get their paychecks deposited a day earlier than I do! I wonder if they will run my credit because it's not great. Sigh.

Hi there-sorry to hear that you get charged for everything. I count myself lucky then, that in the UK we have free banking for bank accounts, savings accounts and credit cards. I've just taken it for granted this is the norm! Well done for shopping around and sorting out a better alternative.

Most of these checking accounts cost fees.

You have to be a fat cat to get around these things.

ING Orange seems to be a good account. I always here good things about them.

Sallie: When I used to work for a certain insurance company (that has a lizard as its mascot), the credit union never ran my credit report. I think it would depend upon your credit union. You might as well ask first.

$haron: Thanks for mentioning me in your recent post. I put my response there!

Kofi: Thanks for visiting. I just went to yours and you have an impressive investment portfolio! I'll be checking up on your progress!

My IT guy at work just sent me this link of a comedy sketch re: a "special" bank. (Warning: This video contains adult humor and crude language.) My IT guy doesn't know about my blog so his timing is impeccable. (Or does he know about my blog? Hmmmmm.....)

Good to know, thanks! I'm gonna wait to see what happens with my job but I think a bank transfer may be happening soon.

good for you! We love our credit union!!! hope you are happy with them!

Post a Comment