Since about a couple weeks ago, I started experiencing serious pain in my left jaw. I was concerned that I would need major dental work (i.e., oral surgery to extract the wisdom tooth). Truth be told, I was more worried that I'll have to pay major out-of-pocket expenses and that my health spending account (aka "Flexible Spending Arrangment" per IRS) wouldn't have enough money to cover it.

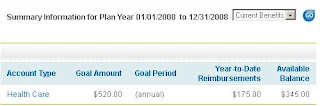

Before I go on, I have to sing a little praise about health spending accounts. Every November, when I make changes to my company benefits, I elect to contribute $20 per paycheck towards my HSA on a pre-tax basis. When the new year rolls along, I will immediately have $520 (i.e., $20 x 26 paychecks) in my account that I can use towards qualified medical expense at any time regardless of the amount I’ve actually contributed!

Before I go on, I have to sing a little praise about health spending accounts. Every November, when I make changes to my company benefits, I elect to contribute $20 per paycheck towards my HSA on a pre-tax basis. When the new year rolls along, I will immediately have $520 (i.e., $20 x 26 paychecks) in my account that I can use towards qualified medical expense at any time regardless of the amount I’ve actually contributed!The draw back to the HSA is that it’s a use-it-or-lose-it plan where I’ll forfeit any money I haven’t spent by December 31. The HSA still is a great deal since my taxable income is reduced by my contribution and my out-of-pocket medical expenses are paid with pre-tax money!

I visited my dentist today and as it turns out, I was diagnosed with temporomandibular disorder (TMD). The causes of TMD are presently unknown but emotional stress is often cited as a cause of TMD (and teeth grinding).

As I’ve said in my prior post, I expect to be laid off at the end of the year. I didn’t think that I was too stressed about this but apparently I am.

The bright side of this all is that all I need to treat my TMD are Advil, a warm compress, soft food and time. No money out of my HSA or my pocket! Yeay!

0 comments:

Post a Comment