I was cleaning piles of paperwork on my desk and found my 2007 Social Security Statement. Apparently, the Administration didn’t have enough time to update my statement since it listed my 2007 income as $242. So I went to the

Social Security Administration’s website to check my estimated benefits.

I’m estimated to get $2,408/month when I retire at 67, or, $2,994/month when I retire at 70. (In case you’re wondering, the present value is only approximately $686/month and $758/month respectively.)

Initially, the SSA takes pains to point out that those are just estimates and the actual figures could differ. Who cares? I’ve heard that Social Security will run out of money some time in 2040, just in time for my retirement! Ha!

Worse yet, pessimists argue that Social Security could run out of money within the

next ten years. Optimists, on the other hand, argue that Social Security

won’t ever run out of money.

Call me a sour puss, but if I had to bet on the federal government administering a bucket of money efficiently and responsibly, I’d rather err on the side of caution and assume I won’t be collecting any Social Security,

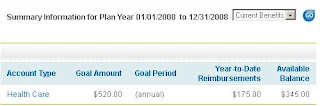

ever. That being said, I need to plan accordingly and I’ve laid out the following retirement planning goals for myself.

1.) Contribute the Maximum Possible to My 401KIn my prior

post, I discussed various reasons why I wasn’t reducing my contributions to attack my debts more aggressively. The potential insolvency of the Social Security system is another big reason, since I won’t be getting a pension.

2.) Contribute the Maximum to my Roth IRAThe Roth is critical since it’ll give me tax-free money in my retirement. Although I don’t expect to be in a very high tax bracket in retirement, it won’t hurt to have some money I can withdraw without having to set aside a portion to pay Uncle Sam.

Additionally, since the Roth is a tax-free (versus a tax-deferred) investment vehicle, it’s also the perfect account to invest in tax-inefficient investments like REITs (real estate investment trusts) and gold ETFs.

Right now, my priority is to pay down debt and save for an emergency fund, so funding my Roth IRA has taken a backseat. But I try to contribute a little bit of money into my Roth IRA every year, even if it’s as little as $490.

3.) Contribute to a Taxable Investment Account The taxable investment account is another form of a tax-deferred account since I won’t incur any tax liabilities until I sell my stocks and ETFs. Additionally, if I’ve held the stocks for over a year, I would only have to pay taxes on my earnings at a favored capital gains rate. (I realize that this tax favored treatment of capital gains may change, depending upon the new administration that gets voted in this year.)

Since I don’t have time to monitor individual stock performances, my investments in my taxabale account have been of the “buy-and-hold” variety, using low-cost ETF’s. I’ve started with $1,000, allocated equally between a foreign large blend ETF (ticker: VEU), a total stock market ETF (ticker: VTI) and an inflation-protected bond ETF (ticker: TIP). (I modeled my starter investment portfolio after the

Margaritaville Portfolio created by Dallas Morning News’ columnist, Scott Burns. When I have more money to invest, I plan to diversify my investments a bit more.)

4.) Buy Long Term Care Insurance When I’m 55 or SoAs you can see from my blog title, I don’t expect to procreate. That means I’ll need someone, other than my kids, to care for my chronic ailments in my old age. (Wow, this is depressing.)

According to Parade Magazine’s February 17, 2008 article, “on average, a home health aides costs $19/hour; an assisted living facility is $2,968/month; a private room in a nursing home is $206/day.” Medicare and Medicaid rarely (if ever) cover these costs.

Parade provides these recommendations:

• Buy from a company that has top financial ratings;

• Avoid policies you need a paycheck to pay for. You must be able to afford premiums after you retire;

• Don’t buy more insurance than you need. Few people require lifetime benefits. The average stay in a nursing home is just 2.5 years and 43% of residents stay less than 1 year;

• Don’t choose a policy solely on the seller’s recommendation.

Another good source for information can be found at

AARP’s website.

5.) Buy An Immediate Annuity When I’m 65It’s bad enough that I won’t have a pension and I’m probably not going to be able to collect any Social Security. But my genetics, ethnic background and my gender all point to a long life. This creates serious concerns that I will outlive my retirement funds.

Ideally, I’d like to get an income stream that will replace the Social Security payments I (probably) won’t be collecting. I’ve estimated that it would cost me about $200,000-$250,000 to purchase an income annuity when I’m between 65-70. (I haven’t really thought this through, but I’ll probably need to tap my 401k to pay for this. I should also remember to purchase the annuity when the interest rates are high.)

The good news with an income annuity is that I’ll get income for life. The bad news is that it won’t be adjusted for inflation like Social Security.

With all that said, am I being paranoid? Maybe. But I'd rather be prepared than sorry.

(Illustration courtesy of Yara's Photostream.)

(Illustration courtesy of Yara's Photostream.)